knoxville tn state sales tax rate

These exceptions include medical supplies and packaging. Current Sales Tax Rate.

Proposed Knox County Budget Includes No Property Tax Increase

This tax does not apply to.

. RE trans fee on. 2020 rates included for use while preparing your income tax deduction. 212 per 100 assessed value.

State Sales Tax is 7 of purchase price less total value of trade in. The Tennessee state sales tax rate is currently. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales.

This amount is never to exceed 3600. What is the sales tax rate in Knoxville Tennessee. For tax rates in other cities see Tennessee sales taxes by city and county.

Sales Tax and Use Tax Rate of Zip Code 37933 is located in Knoxville City Knox County Tennessee State. The tennessee state sales tax rate is 7 and the average tn sales tax after. There is a maximum tax charge of 36 dollars for.

The Knoxville sales tax rate is 0. The Knoxville sales tax rate is 0. 31 rows The latest sales tax rates for cities in Tennessee TN state.

Ad Find Out Sales Tax Rates For Free. What is the sales tax rate in Knoxville Tennessee. 1 State Sales tax is 700.

05 lower than the maximum sales tax in TN. Rates include state county and city taxes. This is the total of state county and city sales tax rates.

2020 rates included for use while preparing your income. 9750 without affidavit of counseling. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a.

3 State Sales tax is 700. The latest sales tax rate for Knoxville TN. Local Sales Tax is 225 of the first 1600.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925. Food is taxed at 4 instead of the state rate of 7. Local sales tax varies by location.

Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County Tennessee State. Sales Tax State Local Sales Tax on Food. Real property tax on median home.

The County sales tax rate is 225. Sales Tax State 700. The minimum combined 2022 sales tax rate for Knox County Tennessee is.

Purchases in excess of 1600 an. Exemptions to the Tennessee sales tax will vary by state. Did South Dakota v.

There is no applicable city tax or special tax. The sales tax is comprised of two parts a state portion and a local. 24638 per 100 assessed value County Property Tax Rate.

Business Tax Guide The Department of Revenue also. Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes. 925 7 state 225 local City Property Tax Rate.

This rate includes any state county city and local sales taxes. The maximum charge for county or city sales tax in Tennessee is 36 on the first 1600 of a cars purchase price. State Sales Tax is 7 of purchase price less total value of trade in.

The base state sales tax rate in Tennessee is 7. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945.

The knoxville tennessee sales tax rate of 925 applies to the following 22 zip codes. 2022 Cost of Living Calculator for TaxesKnoxville Tennessee and Clarksville Tennessee. Sales Tax Knoxville 225.

Knoxville is a city in and the county seat of Knox County in the US. Fast Easy Tax Solutions. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

A single article tax is another. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code. In 2021 Tennessee honored a sales tax holiday three different times.

The state sales tax rate in Tennessee is 7000. You can print a 925 sales tax table here. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax.

The Tennessee sales tax rate is currently 7. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The 925 sales tax rate in knoxville consists of 7 tennessee state sales tax and 225 knox county sales tax.

This is the total of state and county sales tax rates. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. 2020 rates included for use while preparing.

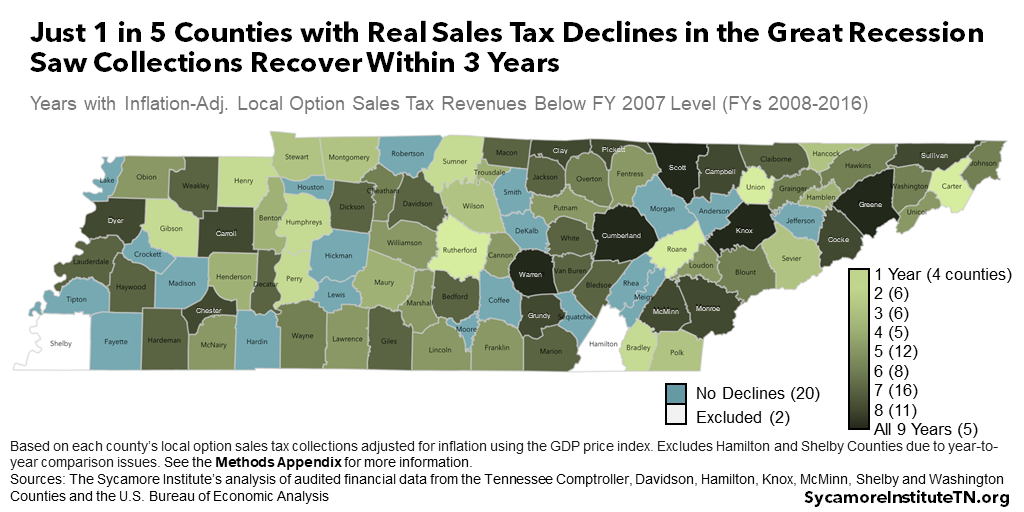

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Llc Tennessee How To Start An Llc In Tennessee Truic

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Taxes Powerpoint Notes Part 3 Sales Tax This Is The Tax Added Onto The Price Of Goods And Services Tennessee Has A State Sales Tax The State Ppt Download

Knoxville Tennessee May Implement Property Tax Increases

Tn 6th Most Regressive Tax System In Us R Nashville

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

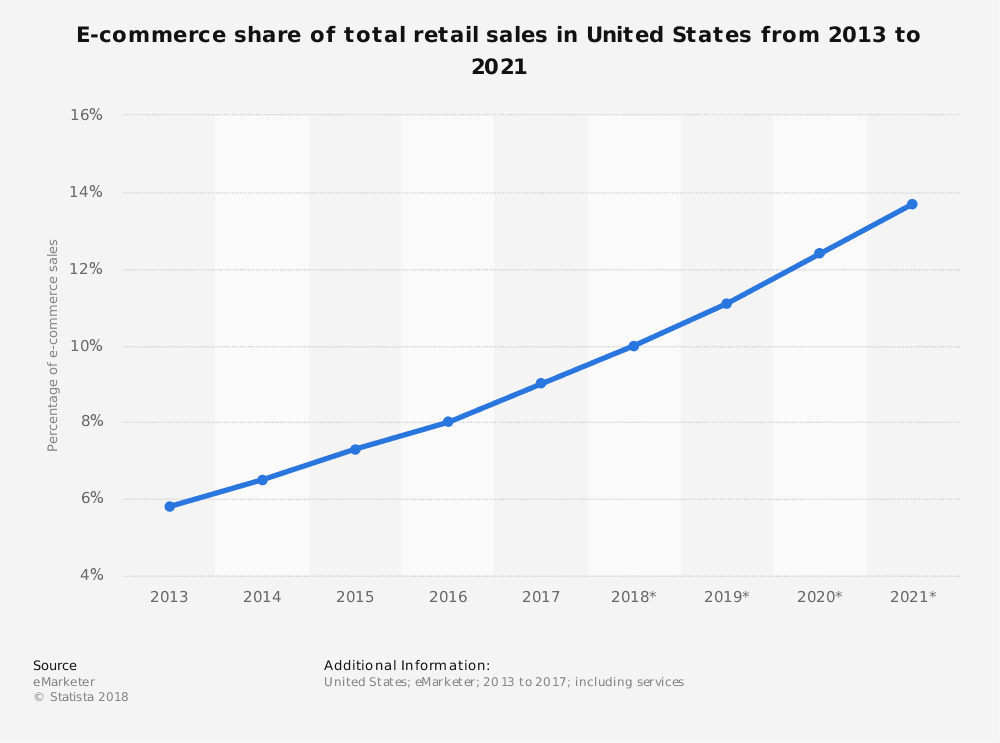

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

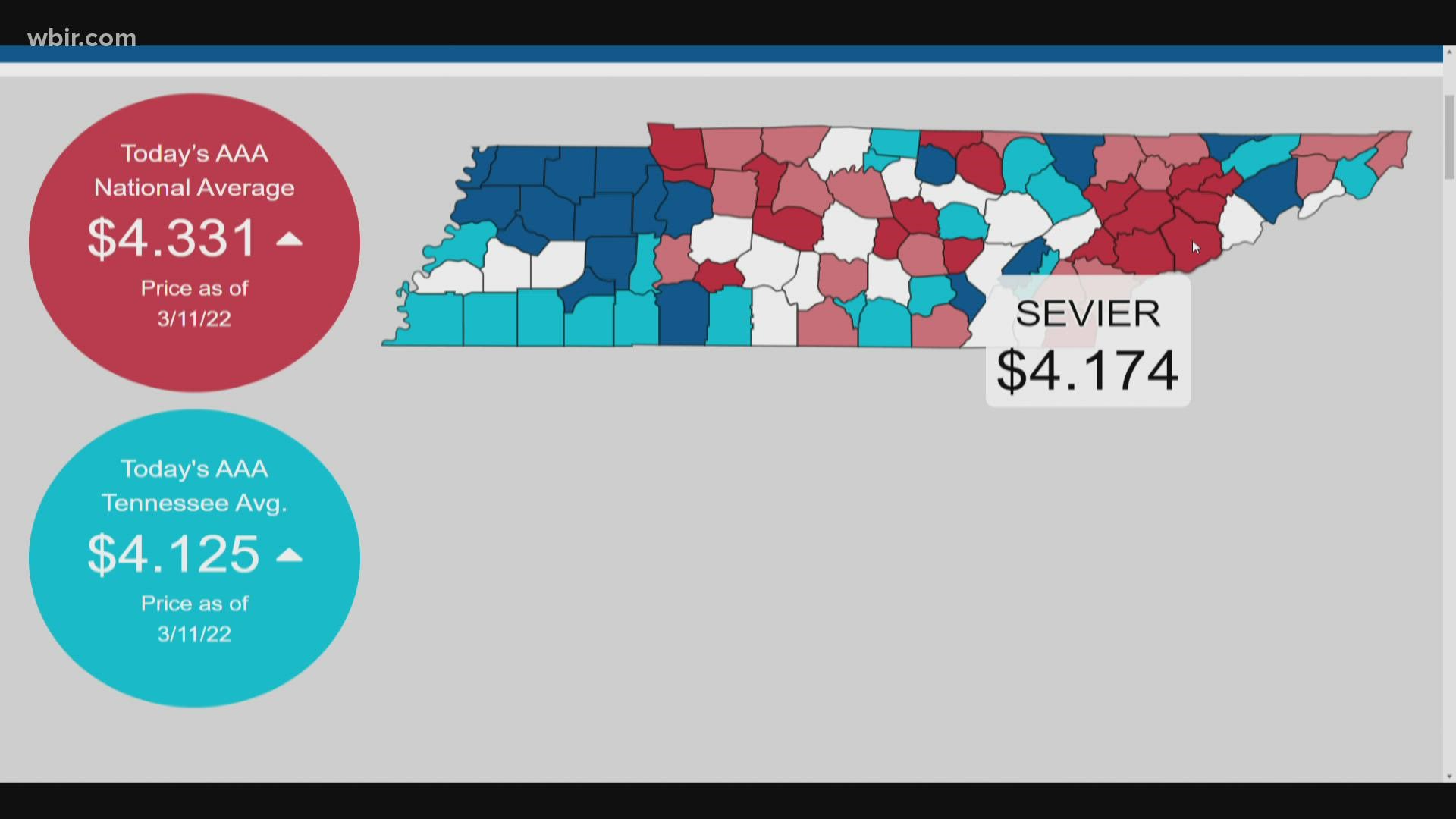

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com

Taxes Powerpoint Notes Part 3 Sales Tax This Is The Tax Added Onto The Price Of Goods And Services Tennessee Has A State Sales Tax The State Ppt Download

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Tennessee Income Tax Calculator Smartasset