unemployment tax break refund when will i get it

When can I expect my unemployment refund. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

4 Steps From E File To Your Tax Refund The Turbotax Blog

Its best to avoid contacting the IRS directly unless the Wheres My Refund tool prompted you to.

. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. The federal tax code counts.

It is worth mentioning that the average unemployment tax. The unemployment tax refund is only for those filing individually. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

This is the fourth round of refunds. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. If you qualify you can use the credit.

The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020. At this stage unemployment. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt.

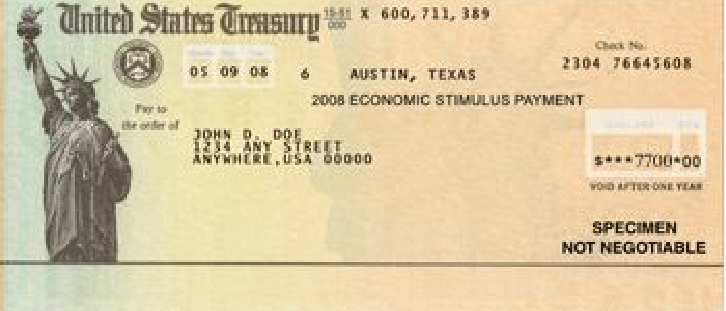

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. If you earned less than 150000 in. If you dont receive your refund in 21 days your tax return might need further review.

Sadly you cant track the cash. Tax season started Jan. IR-2021-71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this.

24 and runs through April 18. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Refund for unemployment tax break.

Check For The Latest Updates And Resources Throughout The Tax Season. The Internal Revenue Service IRS said that it would start sending tax refunds to those eligible for the 10200 unemployment tax waiver this week and continue through the. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The child tax credit checks began.

IR-2021-159 July 28 2021. In general the unemployment tax break refund will depend on the income of the taxpayer and their tax bracket.

More Of Those Surprise Tax Refunds Go Out This Week The Irs Says Will You Get

Tax Refund Timeline Here S When To Expect Yours

46 Of Taxpayers Plan To Save Their Refunds This Year

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

Here S How To Get A Bigger Or Smaller Tax Refund Next Year

6 819 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

A New Round Of Surprise Tax Refunds Is Coming This Week Will You Get One

Still Waiting On Your Tax Refund Here S What You Can Do About It Military Com

Tax Refund Timeline Here S When To Expect Yours

When Will Irs Send Unemployment Tax Refunds 11alive Com

Phony Tax Refunds A Cash Cow For Everyone Krebs On Security

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

Americans Should Be Prepared For A Smaller Tax Refund Next Year

Average Tax Refund Up 11 In 2021

Tax Refund Delays Could Continue As Backlog Of Tax Returns Is Growing Tax Advocate Says Cbs News